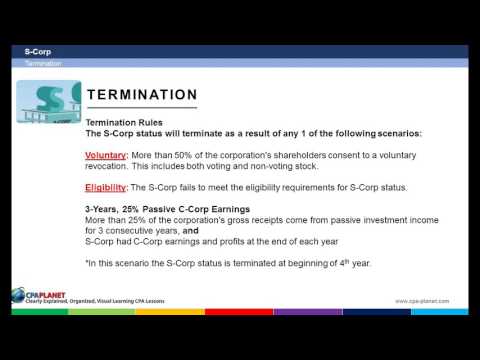

Welcome VP! A planet lessons help you get more points on your CPA exam. These lessons provide clear explanations from the students' perspective using visual learning. We even try to make it interesting and entertaining. Enjoy the lessons and pass the CPA exam. Now, let's discuss the termination of an S Corp. An S Corp will terminate as a result of any one of the following scenarios. This is a question that you may likely encounter on your exam. In scenario one, more than 50% of the corp's shareholders consent to a voluntary relocation that's more than half of the eligibility requirements. If the S Corp fails to meet the eligibility requirements, for example, if it goes from 100 to 101 shareholders, it is no longer eligible. Another scenario is when a C Corp buys them and they are no longer eligible for S Corp status. In scenario two, more than 25% of the gross receipts come from passive income for three consecutive years and there were C Corp earnings and profits at the end of each year. In this case, the S Corp status will be terminated at the beginning of the fourth year. Let's clarify the example in scenario two. If more than 25% of the gross receipts come from passive investment income for three consecutive years and there were C Corp earnings and profits at the end of each year, the S Corp status will be terminated. In the case of termination mid-year, the corporation will have two partial years: a short S Corp year and a short C Corp year. Each of these years will be prorated accordingly. For example, if the termination occurs on May 1st, the short S Corp year will be from January to April 30th, and the short C Corp year will...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1065 Schedule M 3 Charities