As a general rule, the business expenses of one person cannot be deducted by another person. - Under this general rule, the business expenses of a partnership cannot be deducted by a partner. - However, if the partnership agreement requires the partner to pay certain business expenses out of their own funds, then the partner is allowed to deduct the amount as an ordinary and necessary business expense under Section 162. - In Revenue Ruling 7253, a partner was required to pay the wages of an employee of the partnership. In this case, the partner was allowed to deduct the wages paid as an ordinary and necessary business expense. - These types of expenses are sometimes referred to as unreimbursed partnership expenses or UPE.

Award-winning PDF software

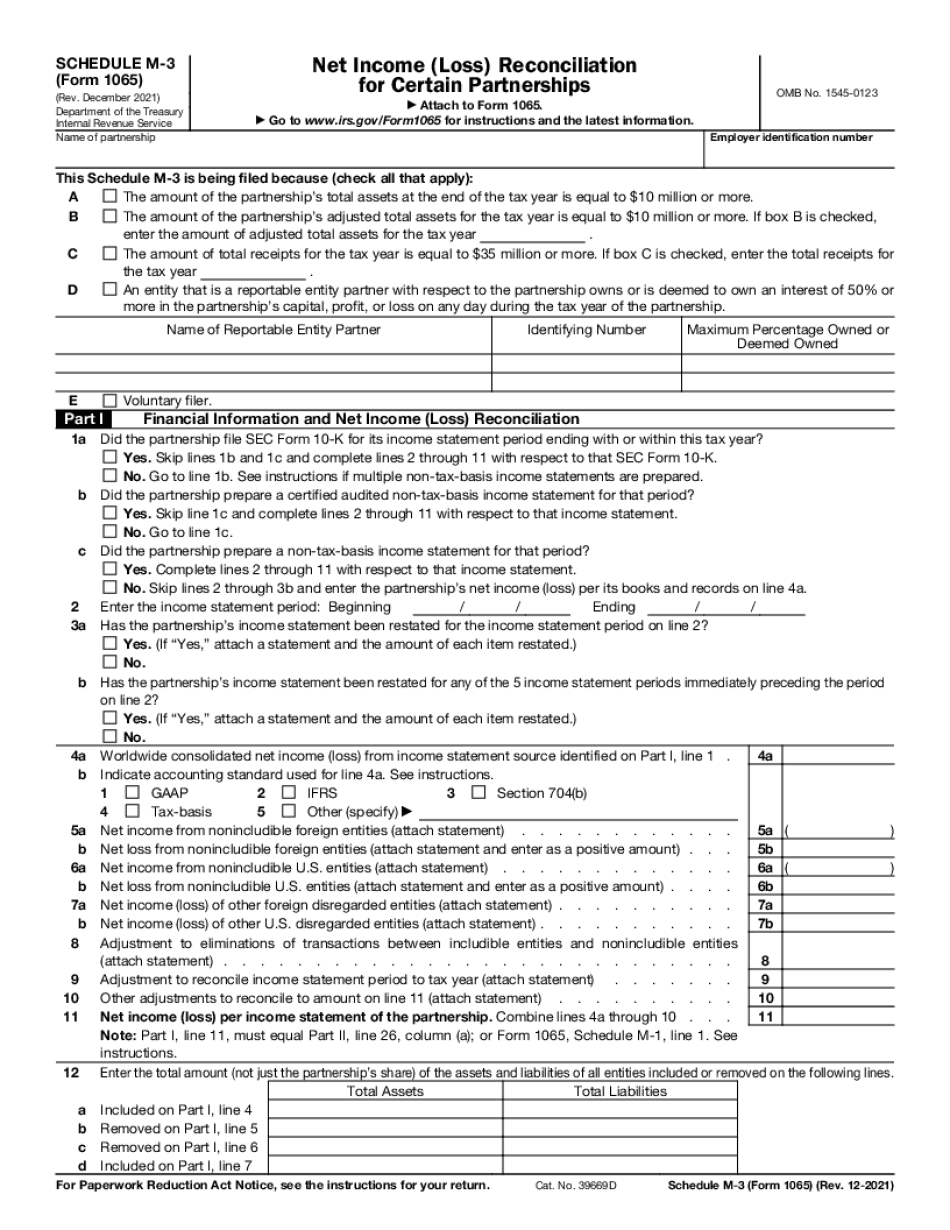

Video instructions and help with filling out and completing Can Form 1065 Schedule M 3 Percentage