Hi, she took away the CPA with eight attacks and accounting. For this week, we will be talking about LLCs and S corporations. It loves talking about this topic, you know, because my company concentrates on small business owners in pass-through entities. So, I love giving tax tips to help lower that tax bill for my clients. S corporations and LLCs, you know, they're both great entities. They both offer that legal protection, operational advantages, and the pass-through income to the income tax return. But if we're talking about taxes, LLCs do not save on taxes. Yep, you've heard that right. LLCs do not save on taxes. LLCs are great for asset protection, you know, for the long term. But if your company makes more than thirty or forty thousand a year, you have to consider converting it to an S corporation. Why? Because the net profit in an LLC, all of it passes through to the personal income tax return and all of it is subject to something called self-employment tax. The self-employment tax includes FICA taxes, your Social Security, and your Medicare, okay? All of it is subject to self-employment tax. On the other hand, an S corporation only the salary portion of the owner is subject to the self-employment tax, but not the distribution, which is great. It's a huge tax saving for small business owners. Let's take a look at an example because I think if you see it, it's better to really understand it. So, let's consider two entities. We have an LLC here and we have an S corporation here. And for simplicity reasons, let's say that both of them have a net profit of a hundred thousand. And when I say net profit, I'm talking about after you have paid your cost of...

Award-winning PDF software

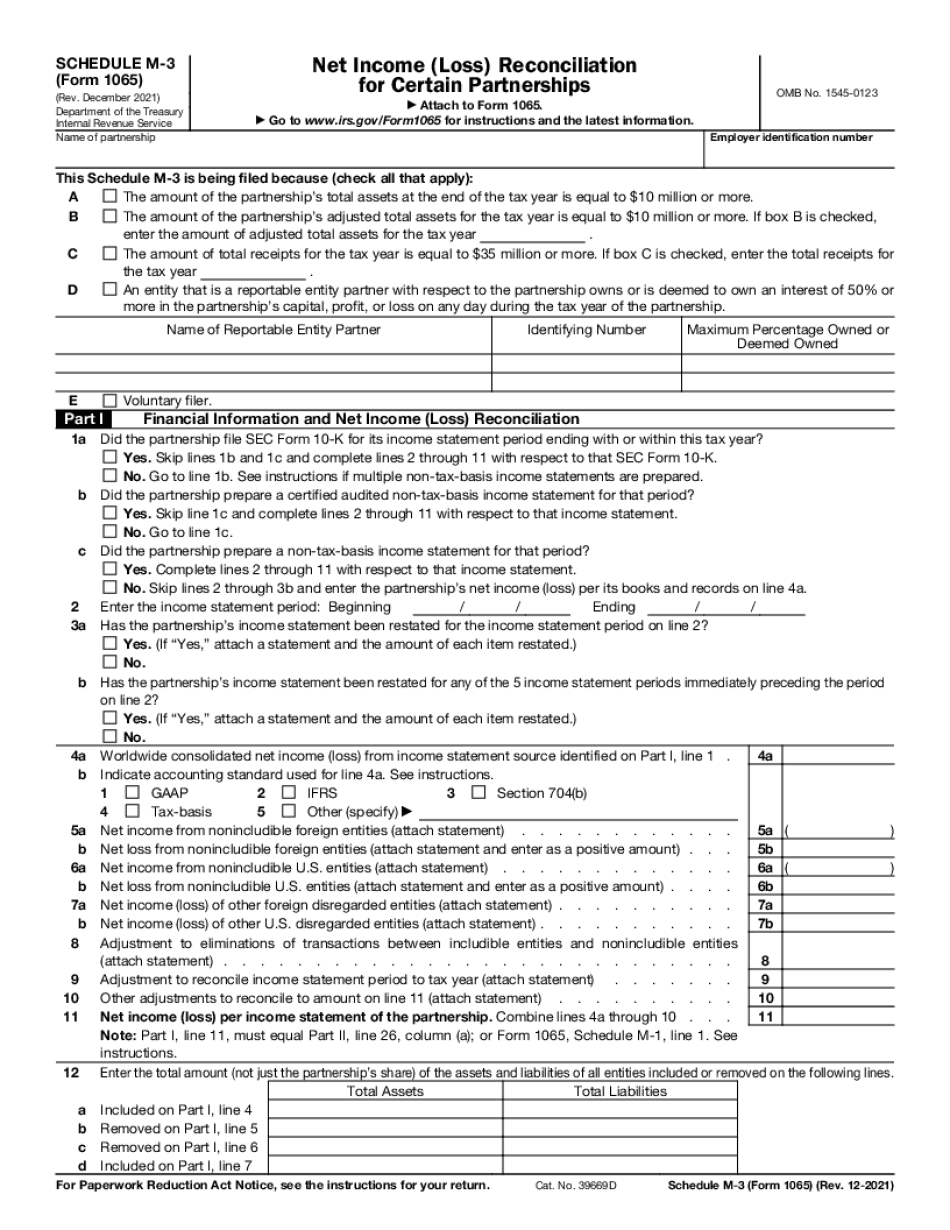

Video instructions and help with filling out and completing When Form 1065 Schedule M 3 Compensation