I'm securities attorney Laura Anthony, founding partner of Legal & Compliance, a full-service corporate securities and business transactions law firm. Today is a continuation in a lawcast series discussing sections 16 and 13 of the Securities Exchange Act related to insider reporting requirements. Today, I am continuing my discussion of section 13, including required amendments. In the last lawcast in this series, I discussed sections 13 in general, including a precursor of schedule 13d and 13g. Section 13 requires that any person that has acquired either directly or indirectly more than 5% of the beneficial ownership of a reporting company's equity securities to file either a schedule 13d or schedule 13g within 10 days after the acquisition. The disclosure statement includes, among other things, the identity of the beneficial owners, the amount of beneficial ownership, and plans or proposals regarding the issuer. For purposes of calculating beneficial ownership under Section 13, the shareholder must include any securities that they can acquire within 60 days. So, if the shareholder owns a convertible note, warrant, or an option that can convert into equity securities within 60 days, they have to include those equity securities in their calculation of beneficial ownership for purposes of filing their schedule 13d or schedule 13g. If the right to acquire those securities is pre-conditioned on an event that has not occurred yet, such as a transaction closing or other milestones, then those securities would not be included in the beneficial ownership because there's no right to acquire them as of that time. Another example would be if there's an equity blocker in the canoe rights of a convertible instrument. If there's an equity blocker at 4.99 percent, then the shareholder is prevented from reaching five percent and so would not be required to file a schedule 13d. Amendments to a schedule 13d must...

Award-winning PDF software

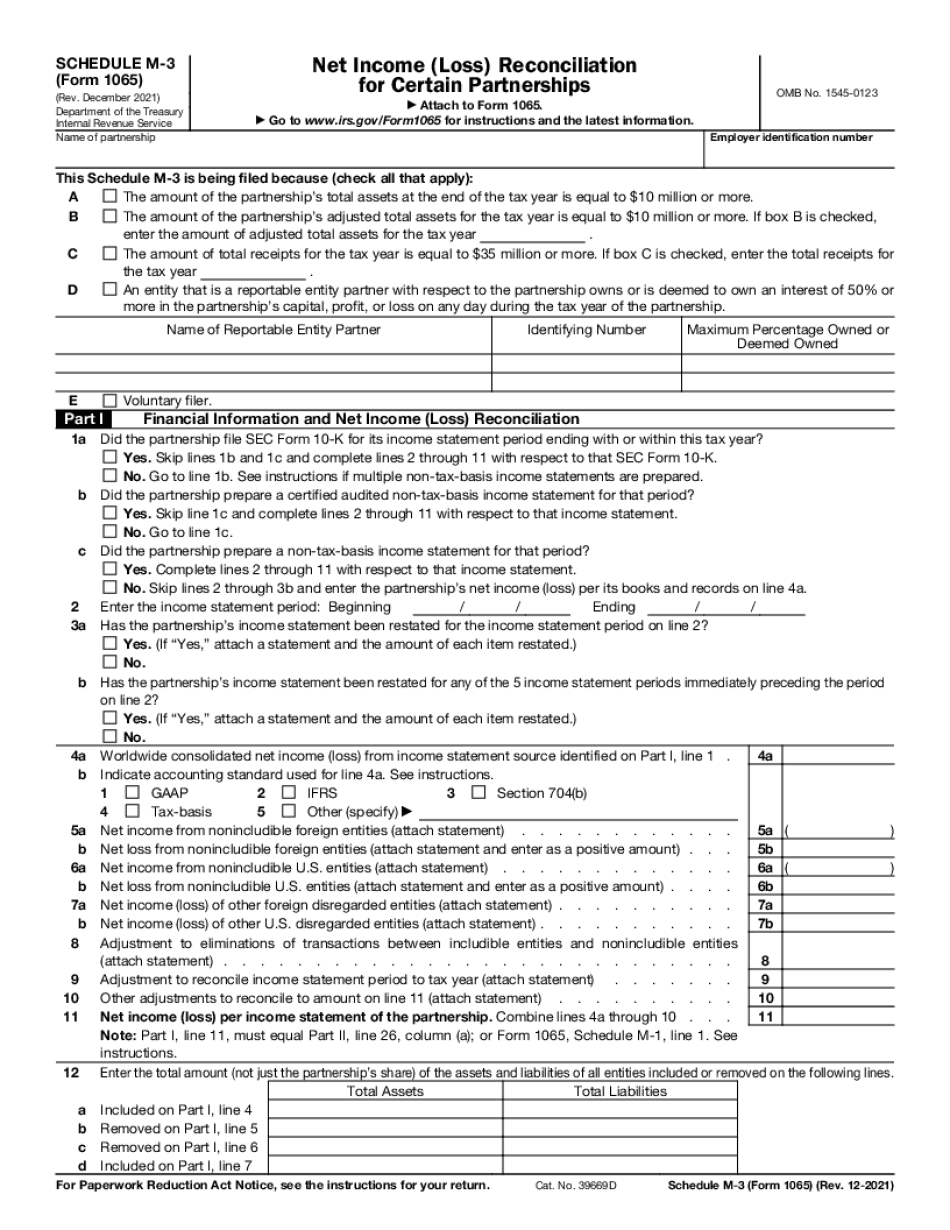

Video instructions and help with filling out and completing Why Form 1065 Schedule M 3 Securities